Earn a Dollar-for-Dollar Tax Credit while Empowering Foster Youth

Reduce their hardship while reducing your taxes

Advocates for Children is honored to be among the select organizations in Georgia approved to receive funding through the Fostering Success Act (FSA). This incredible opportunity enables you to redirect your state tax dollars to make a direct impact on the lives of youth aging out of foster care.

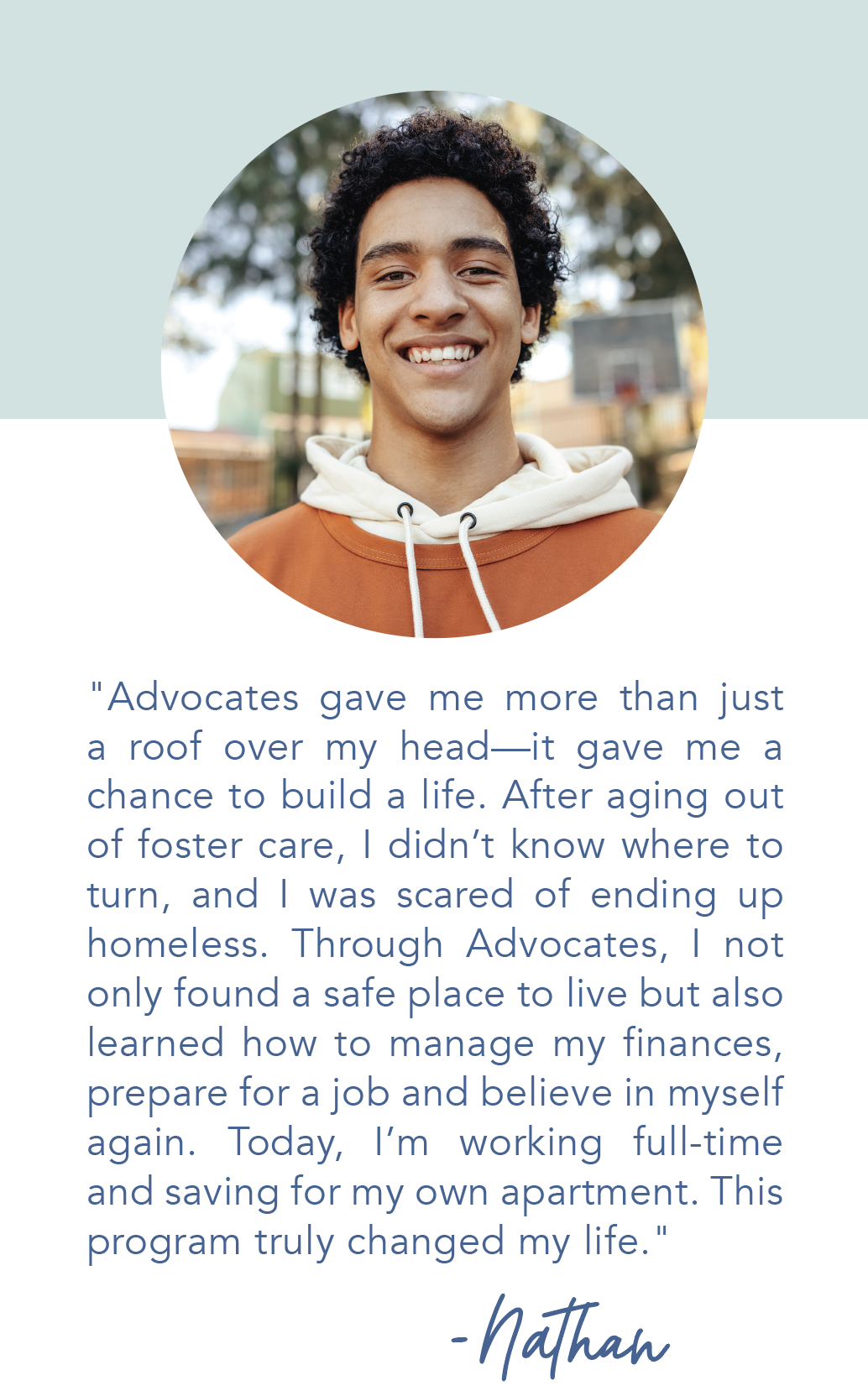

Advocates provides a year of wrap-around services to young adults aging out of foster care, including housing assistance and skills training for adulthood. When you support this vital program, you help hundreds of young adults who are most vulnerable to homelessness, substance abuse, sex trafficking and early pregnancy.

Why Participate?

Impact Lives

Support our Youth and Young Adult In- dependent Housing program, assisting young people at risk of homelessness, poverty and unemployment.

Tax Benefit

Receive a dollar-for-dollar reduction in your Georgia state tax liability.

HOW THE TAX CREDIT WORKS:

Your Contribution = Your Tax Credit

EXAMPLE:

Owe $10,000 in Georgia taxes? Contribute $10,000 to Advocates for Children and reduce your tax bill to $0.

Who Can Participate and

Maximum Contribution Amounts

Whether you’re an individual, business owner, or corporation, you can make a transformational impact on the lives of foster youth—just by choosing where your tax dollars go.

- Individuals or Heads of Household

- Married Couples Filing Jointly

- LLCs, S Corps, or Partnerships

- Corporations

People in these filing groups can donate 1005 of their tax liability to Advocates for children

HOW TO APPLY:

STEP 1: GET PRE-APPROVED/ PRE-APPLY FOR APPROVAL

1. Before you donate, pre-approval is required.

2. For individuals married and filing jointly, either spouse can apply for the exemption. Have your spouse’s name and social security number ready.

3. Visit www.gtc.dor.ga.gov to create an account at the Georgia Tax Center website.

5. Select Advocates for Children as the Foster Child Support Organization.

6. You will receive this approval letter from the Georgia Department of Revenue.

STEP 2: MAKE YOUR CONTRIBUTION

1. Act Quickly – You must donate within 60 days of approval.

2. Donate to Advocates for Children:

Online: givebutter.com/fosteringsuccess

By Mail: Send a check with “FSA Tax Credit” in the memo line to: Advocates for Children | PO Box 446 Cartersville, GA 30120

STEP 3: CLAIM YOUR TAX CREDIT

1. Receive Confirmation – We will send you Form IT-QFCD-FUND1 for your records.

2. File Your Taxes – Include Form IT-QFCD-TP2 to claim your tax credit.